Wells Fargo Home Mortgage on 4398 Delaware 1 in Lewes, DE

Welcome to Wells Fargo Home Mortgage (Banks) on 4398 Delaware 1 in Lewes, Delaware. This bank is listed on Bank Map under Banks - All - Banks. You can reach us on phone number (302) 226-8521, fax number or email address . Our office is located on 4398 Delaware 1, Lewes, DE.

Popular links

Wells Fargo Home Mortgage Branch Overview

Available accounts

CDs

Checking

Credit Cards

Debit Cards

Gift Cards

Health Savings Account (HSAs)

IRAs

Savings

Contact details

Address

Wells Fargo Home Mortgage

4398 Delaware 1, Lewes

19971 DE, USA

Call Us

(302) 226-8521

For full contact details (including navigation data) to this bank have a look at the the column to your right (or scroll if you're viewing this on a mobile device.)

Articles Recommended for You

5 Finance Tricks Every Twenty-Something Should Know

There is a lot to worry about once you graduate college with your new degree. Still, personal finance and investing in particular should be a priority. By getting a head start with proper money management, you can greatly increase later returns. Here are our 5 tricks to maximizing your investments!

How to Make Money in Real Estate

Getting started in real estate investing can be expensive, but lucrative. Review our investment and financing strategies to learn how you can get started.

The Real Issue with Obama’s 529 Plan

In his State of the Union address, President Obama made "middle-class economics" his theme. One proposal that emerged from the evening was a new way to handle 529 college savings plans and Coverdell Education Savings Accounts: remove the favorable tax treatment each receives. Here's why there's reason to believe the president's plan is misguided.

Other banks near 4398 Delaware 1

Wsfs Bank on 19335 Coastal Hwy (0.5 miles away)

County Bank on 4299 Delaware 1 (0.5 miles away)

PNC Bank on 19745 Sea Air Ave (0.5 miles away)

Bank Of Delmarva on 4575 Delaware 1 (0.5 miles away)

Citizens Bank on 41 Rehoboth Ave (0.5 miles away)

Chevy Chase Bank on 22 Lighthouse Dr (0.5 miles away)

Wilmington Trust on 134 2nd St (3.4 miles away)

Washington Mutual on 60 Clay Rd (3.4 miles away)

Citizens Bank on 131 2nd St (3.4 miles away)

Wilmington Trust on 107 Front St (9.9 miles away)

County Bank on 140 Broadkill Rd (9.9 miles away)

County Bank on 10 Old Mill Rd (11 miles away)

Baltimore Trust on Delaware 26 & State Route 17 (11 miles away)

Taylor Bank on 50 Atlantic Ave (11 miles away)

PNC Bank on 19312 Lighthouse Plaza Blvd (12.5 miles away)

PNC Bank on 2 Pennsylvania Ave (13.5 miles away)

Wilmington Trust on Pennsylvania Ave & 1st St (13.5 miles away)

PNC Bank on 220 Town Center Dr (13.5 miles away)

PNC Bank on 31231 Americana Pky (13.5 miles away)

PNC Bank on 104 Main St (14.3 miles away)

This Wells Fargo Home Mortgage is located nearby...

Not sure where Wells Fargo Home Mortgage on 4398 Delaware 1 is? The following places (sorted by popularity) are located nearby. We've also included the estimated walking distance.

Big Fish Grill Rehoboth (0.90 miles away / 18 min walk)Cultured Pearl The Restaurant & Sushi Bar (1.44 miles away / 29 min walk)

Cracker Barrel Old Country Store (0.27 miles away / 5 min walk)

DOS LOCOS (1.66 miles away / 33 min walk)

Jungle Jims WaterPark (0.69 miles away / 14 min walk)

Tanger Outlets, Rehoboth (0.10 miles away / 2 min walk)

Summer House Restaurant and Saloon (1.59 miles away / 32 min walk)

Nicola Pizza (1.83 miles away / 37 min walk)

Club Fitness (1.31 miles away / 26 min walk)

TGI Fridays Rehoboth Beach (0.79 miles away / 16 min walk)

Corporate overview

Wells Fargo operate bank branches in 41 US states (along with online banking available for customers in all states.) Wells Fargo was funded in 1852 and had 6,289 branches and 230,000 employees last year. Wells Fargo is one of the largest banks in The United States (2nd largest bank in deposits, home mortgage servicing, and debit cards.) It's also the 23rd largest company in the United States. The headquarter is located in sioux falls, South Dakota,

Total employees

230,533

Total branches

231

Total deposits

$1.01 trillion (The total dollar amount of cash deposits held by Wells Fargo end of last financial quarter.)

Total loans

$778 billion (The total dollar amount of loans held by Wells Fargo end of last financial quarter.)

FDIC

3511

Year founded

1852

Financial Strength

Texas Ratio

29.59%

Deposit Growth

0.081%

Core Capitalization Ratio

8.86%

Wells Fargo Financial Statement

| TOTAL ASSETS | $1,284,538,000 |

| Cash and Due from Depository Accounts | $137,155,000 |

| Interest-Bearing Balances | $119,728,000 |

| Securities | $217,652,000 |

| Federal Funds Sold and Reverse Repurchase Agreements | $24,894,000 |

| Net Loans and Leases | $764,011,000 |

| Total Loans | $777,820,000 |

| Loan Loss Allowance | ($13,809,000) |

| Trading Account Assets | $32,173,000 |

| Bank Premises and Fixed Assets | $7,595,000 |

| Other Real Estate Owned | $3,068,000 |

| Goodwill and Other Intangibles | $43,391,000 |

| All Other Assets | $54,677,000 |

| TOTAL LIABILITIES | $1,145,682,000 |

| Total Deposits | $1,011,644,000 |

| Interest-Bearing Deposits | $763,046,000 |

| Deposits Held in Domestic Offices | $924,162,000 |

| % Insured | 56.94% |

| Federal Funds Purchased and Repurchase Agreements | $27,862,000 |

| Trading Liabilities | $17,166,000 |

| Other Borrowed Funds | $35,971,000 |

| Subordinated Debt | $19,943,000 |

| All Other Liabilities | $33,096,000 |

| TOTAL EQUITY | $138,856,000 |

| Total Bank Equity Capital | $137,808,000 |

| Perpetual Preferred Stock | $0 |

| Common Stock | $519,000 |

| Surplus | $102,952,000 |

| Undivided Profits | $34,337,000 |

| Noncontrolling Interests in Consolidated Subsidiaries | $1,048,000 |

| INCOME AND EXPENSE | |

| Net Interest Income | $19,491,000 |

| Total Interest Income | $20,803,000 |

| Total Interest Expense | ($1,312,000) |

| Provision For Loan and Lease Losses | ($1,768,000) |

| Total Noninterest Income | $15,033,000 |

| Fiduciary Activities | $845,000 |

| Service Charges on Deposit Accounts | $2,492,000 |

| Trading Account Gains and Fees | $1,459,000 |

| Additional Noninterest Income | $10,237,000 |

| Total Noninterest Expense | ($18,769,000) |

| Salaries and Employee Benefits | ($10,988,000) |

| Premises and Equipment Expense | ($2,105,000) |

| Additional Noninterest Expense | ($5,676,000) |

| Pre-Tax Net Operating Income | $13,987,000 |

| Securities Gains (Losses) | $-20,000 |

| Applicable Income Taxes | $4,528,000 |

| Income Before Extraordinary Items | $9,439,000 |

| Extraordinary Gains - Net | $0 |

| Net Income Attributable to Bank | $9,306,000 |

| Net Income Attributable to Noncontrolling Interests | $133,000 |

| Net Income Attributable to Bank and Noncontrolling Interests | $9,439,000 |

| Net Charge-Offs | $2,107,000 |

| Cash Dividends | $2,500,000 |

| Sale, Conversion, Retirement of Capital Stock, Net | $0 |

| Net Operating Income | $9,452,600 |

| PERFORMANCE AND CONDITION RATIOS | |

| Performance Ratios (%, Annualized) | |

| Yield on Earning Assets | 3.69% |

| Cost of Funding Earning Assets | 0.23% |

| Net Interest Margin | 3.46% |

| Noninterest Income to Average Assets | 2.36% |

| Noninterest Expense to Average Assets | 2.95% |

| Net Operating Income to Assets | 1.48% |

| Return on Assets (ROA) | 1.46% |

| Pretax Return on Assets | 2.17% |

| Return on Equity | 13.67% |

| Retained Earnings to Average Equity (YTD only) | 9.99% |

| Net Charge-offs to Loans | 0.54% |

| Credit Loss Provision to Net Charge-offs | 83.91% |

| Earnings Coverage of Net Loans Charge-Offs | 7.48(x) |

| Efficiency Ratio | 52.29% |

| Assets per employee ($ millions) | $5.572 |

| Cash Dividends to Net Income (YTD only) | 26.86% |

| Condition Ratios (%) | |

| Loss Allowance to Loans | 1.78% |

| Loss Allowance to Noncurrent Loans | 32.65% |

| Noncurrent Assets Plus Other Real Estate Owned to Assets | 3.54% |

| Noncurrent Loans to Loans | 5.44% |

| Net Loans and Lease to Deposits | 75.51% |

| Net Loans and Leases to Core Deposits | 87.33% |

| Equity Capital to Assets | 10.73% |

| Core Capital Ratio | 8.86% |

| Tier 1 Risk-based Capital Ratio | 10.83% |

| Total Risk-based Capital Ratio | 13.48% |

| OTHER KEY FIGURES | |

| Asset-Side | |

| Average Assets | $1,274,094,333 |

| Average Earning Assets | $1,126,233,667 |

| Average Loans | $777,280,000 |

| Noncurrent Loans and Leases | $42,289,000 |

| Noncurrent Loans that are Wholly or Partially Guaranteed by the U.S. Government | $21,354,000 |

| Income Earned, Not Collected on Loans | $4,607,000 |

| Earning Assets | $1,138,150,000 |

| Long-Term Assets (5+ Years) | $370,700,000 |

| Average Assets, YTD | $1,274,094,333 |

| Average Assets, 2 Year | $1,278,079,000 |

| Total Risk Weighted Assets | $1,012,290,100 |

| Adjusted Average Assets for Leverage Capital Purposes | $1,236,866,000 |

| Life Insurance Assets | $17,749,000 |

| General Account Life Insurance Assets | $4,450,000 |

| Separate Account Life Insurance Assets | $12,764,000 |

| Hybrid Account Life Insurance Assets | $535,000 |

| Insider Loans | $85,551 |

| Loans and Leases Held For Sale | $23,419,000 |

| Liability-Side | |

| Volatile Liabilities | $134,606,000 |

| FHLB Advances | $203,000 |

| Unused Loan Commitments | $370,931,000 |

| Total Unused Commitments | $370,931,000 |

| Equity-Side | |

| Average Equity | $136,201,666 |

| Tier 1 (core) Risk-Based Capital | $109,630,000 |

| Tier 2 Risk-Based Capital | $26,904,000 |

| Derivatives | $2,147,483,647 |

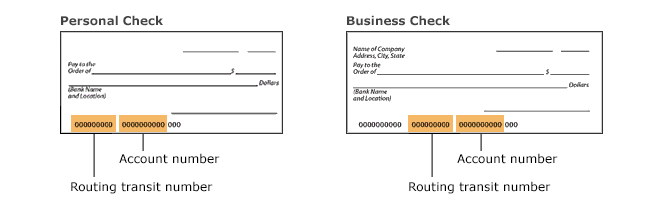

Routing numbers

Wells Fargo Home Mortgage Lewes routing numbers are listed on this site along with more information about how to find your routing number. Call Wells Fargo Home Mortgage for more information about routing numbers.

Routing numbers to Wells Fargo Home Mortgage in Lewes are collected manually from the banks official website or provided by the Federal Reserve Financial Services Database.

Also known as banking routing numbers, routing transit numbers, RTNs, and SWIFT codes. Routing numbers are different from checking and savings accounts, prepaid cards, IRAs, lines of credit, and wire transfers.

Looking for your account number? Review your account statement or visit a Wells Fargo banking location.

Checking/savings/money Market Accounts

You can find your nine digit routing number on the lower left corner of checks. (Keep in mind that the routing number is based on where you first opened your account.)

For wire transfers, use the routing number 121000248 for domestic wires and the SWIFT code WFBIUS6S for international wires.

Did you open your account online or by phone? Please refer to your checks or call 24/7 at 1-800-TO-WELLS (1-800-869-3557).

Alabama 62000080Alaska 125200057

Arizona 122105278

Arkansas 111900659

California 121042882

Colorado 102000076

Connecticut 21101108

Delaware 31100869

District of Columbia 54001220

Florida 63107513

Georgia 61000227

Hawaii 121042882

Idaho 124103799

Illinois 71101307

Indiana 74900275

Iowa 73000228

Kansas 101089292

Kentucky 121042882

Louisiana 121042882

Maine 121042882

Maryland 55003201

Massachusetts 121042882

Michigan 91101455

Minnesota 91000019

Mississippi 62203751

Missouri 121042882

Montana 92905278

Nebraska 104000058

Nevada 321270742

New Hampshire 121042882

New Jersey 21200025

New Mexico 107002192

New York 26012881

North Carolina 53000219

North Dakota 91300010

Ohio 41215537

Oklahoma 121042882

Oregon 123006800

Pennsylvania 31000503

Rhode Island 121042882

South Carolina 53207766

South Dakota 91400046

Tennessee 64003768

Texas 111900659

Texas - El Paso 112000066

Utah 124002971

Vermont 121042882

Virginia 51400549

Washington 125008547

West Virginia 121042882

Wisconsin 75911988

Wyoming 102301092

American Samoa 121042882

North Mariana Islands 121042882

Puerto Rico 121042882

Virgin Islands 121042882

American Forces Abroad 121042882

Job Openings

Open positions for Wells Fargo Home Mortgage in Lewes.

Consumer Complaint Stats

| Product / Complaint category | Complaints in 2013 |

|---|---|

| Mortgage | 100 |

| Bank account or service | 49 |

| Credit card | 5 |

| Consumer loan | 4 |

| Student loan | 3 |

| Debt collection | 1 |

Wells Fargo Home Mortgage Consumer Complaints (Delaware, 2013)

Average ratio for Wells Fargo Home Mortgage: 12.77 complaints per branch.These numbers are gathered from the CFPB (Consumer Financial Protection Bureau) to give you a transparent overview of complaints Wells Fargo Home Mortgage in Delaware received in 2013.

Having problems with your bank? File a bank account or service complaint here.

Wells Fargo Home Mortgage Bank Hours (Business hours)

These are the bank hours for Wells Fargo Home Mortgage. Call (302) 226-8521 to learn more about office hours. Please note that these bank hours are general and other hours of operation may apply on certain holidays.

Monday 9:00 am - 6:00 pm

Tuesday 9:00 am - 6:00 pm

Wednesday 9:00 am - 6:00 pm

Thursday 9:00 am - 6:00 pm

Friday 9:00 am - 6:00 pm

Saturday 10:00 am - 4:00 pm

Sunday closed

Fees, interest rates and costs

There's currently no additional information available about fees or rates for Wells Fargo Home Mortgage.

Ask a question or leave a comment

We'd love to hear about your experience. Did you suffer through long waiting times, unprofessional staff or high fees or were you treated with great customer service, the business hours you were expecting and a great overall experience? This is your chance to share your thoughts about this branch and help other consumers get the best banking experience in your city.0 Comments, Questions or Reviews - Add

Be the first person to leave a comment, ask a question or review this bank.

Share your experience

We'd love to hear about your experience with Wells Fargo Home Mortgage. Did you suffer through long waiting times, unprofessional staff or high fees or were you treated with great customer service, the business hours you were expecting and a great overall experience? This is your chance to share your thoughts about this branch and help other consumers get the best banking experience in Lewes.Address

Bank location

Bank address

Wells Fargo Home Mortgage 4398 Delaware 1Lewes, DE 19971

Navigation data

Area Code: 302Latitude: 38.7178009

Longitude: -75.1128321

County: Sussex

FIPS county code: 10005 Ask question Write review

External resources

ATM locator

Routing Numbers

Official website

Business hours

Wells Fargo Home Mortgage Bank Hours (Business hours)

These are the bank hours for Wells Fargo Home Mortgage. Call (302) 226-8521 to learn more about office hours. Please note that these bank hours are general and other hours of operation may apply on certain holidays.

Monday 9:00 am - 6:00 pm

Tuesday 9:00 am - 6:00 pm

Wednesday 9:00 am - 6:00 pm

Thursday 9:00 am - 6:00 pm

Friday 9:00 am - 6:00 pm

Saturday 10:00 am - 4:00 pm

Sunday closed

Phone

Phone: (302) 226-8521

Fax: No listed fax number.

Email address

No listed email address.

Areas of practice

Wells Fargo Home Mortgage is listed under Banks in Lewes, Delaware .

Pro tip Browse Banks & bank offices in Lewes, Delaware by bank issue and category.

wells fargo lewes