Chevy Chase Bank on 45545 Dulles Eastern Plaza in Sterling, VA

Welcome to Chevy Chase Bank (Banks) on 45545 Dulles Eastern Plaza in Sterling, Virginia. This bank is listed on Bank Map under Banks - All - Banks. You can reach us on phone number (703) 444-8441, fax number or email address . Our office is located on 45545 Dulles Eastern Plaza, Sterling, VA.

Popular links

Chevy Chase Bank Branch Overview

Available accounts

CDs

Checking

Credit Cards

Debit Cards

Gift Cards

Health Savings Account (HSAs)

IRAs

Savings

Contact details

Address

Chevy Chase Bank

45545 Dulles Eastern Plaza, Sterling

20166 VA, USA

Call Us

(703) 444-8441

For full contact details (including navigation data) to this bank have a look at the the column to your right (or scroll if you're viewing this on a mobile device.)

Articles Recommended for You

5 Finance Tricks Every Twenty-Something Should Know

There is a lot to worry about once you graduate college with your new degree. Still, personal finance and investing in particular should be a priority. By getting a head start with proper money management, you can greatly increase later returns. Here are our 5 tricks to maximizing your investments!

How to Make Money in Real Estate

Getting started in real estate investing can be expensive, but lucrative. Review our investment and financing strategies to learn how you can get started.

The Real Issue with Obama’s 529 Plan

In his State of the Union address, President Obama made "middle-class economics" his theme. One proposal that emerged from the evening was a new way to handle 529 college savings plans and Coverdell Education Savings Accounts: remove the favorable tax treatment each receives. Here's why there's reason to believe the president's plan is misguided.

Other banks near 45545 Dulles Eastern Plaza

First Virginia Bank on 101 Enterprise St (1.3 miles away)

Chevy Chase Bank on 21800 Towncenter Plaza #225 (1.3 miles away)

Capital One Bank on 46160 Potomac Run Plaza (1.3 miles away)

Suntrust Bank on 46340 Potomac Run Plaza (1.3 miles away)

Champney Robert E on 101 E Holly Ave (1.3 miles away)

PNC Bank on 47030 Community Plaza (1.3 miles away)

Florczyk- Keith R on 43650 Jennings Farm Dr (1.3 miles away)

BB and T on 22550 Davis Dr (1.3 miles away)

M and T Bank on 47100 Community Plaza (1.3 miles away)

Chevy Chase Bank on 21800 Towncenter Plaza (1.3 miles away)

Bank of America on 42030 Village Center Plz (1.3 miles away)

United Bank on 21036 Tripleseven Rd (2.1 miles away)

Cardinal Bank on 46005 Regal Plaza (2.1 miles away)

Bank of America on 45985 Regal Plaza #180 (2.1 miles away)

First Virginia Bank on 20921 Davenport Dr (2.1 miles away)

First Virginia Bank on 20789 Great Falls Plaza (2.1 miles away)

First Virginia Bank on 20522 Falcons Landing Cir (2.1 miles away)

Capital One Bank on 43931 Farmwell Hunt Plaza (3.7 miles away)

Bank of America ATM on 20101 Academic Way (3.7 miles away)

Bb and T on 43365 Junction Plaza (3.7 miles away)

This Chevy Chase Bank is located nearby...

Not sure where Chevy Chase Bank on 45545 Dulles Eastern Plaza is? The following places (sorted by popularity) are located nearby. We've also included the estimated walking distance.

Dulles Town Center (0.57 miles away / 11 min walk)The Cheesecake Factory (0.62 miles away / 12 min walk)

Gold's Gym Sterling (1.55 miles away / 31 min walk)

Dulles Sportsplex (0.53 miles away / 11 min walk)

Olive Garden (0.99 miles away / 20 min walk)

Bungalow Lakehouse (1.27 miles away / 25 min walk)

LA Fitness (0.58 miles away / 12 min walk)

Sweetwater Tavern Sterling (1.01 miles away / 20 min walk)

P.F. Chang's China Bistro (0.63 miles away / 13 min walk)

O'Faolain's Irish Restaurant and Pub (1.15 miles away / 23 min walk)

Corporate overview

Known as Chase Manhattan Bank until the merger with J.P. Morgan & Co in 2000, Chase is one of the biggest banks in the United States with 5,000+ branches and 16,000+ ATMs. "The Banker" (a British magazine) rated Chase as worlds best bank in 2009-10.

Total employees

200,088

Total branches

120

Total deposits

$1.25 trillion (The total dollar amount of cash deposits held by Chase end of last financial quarter.)

Total loans

$624 billion (The total dollar amount of loans held by Chase end of last financial quarter.)

FDIC

628

Year founded

1824

Financial Strength

Texas Ratio

18.43%

Deposit Growth

0.071%

Core Capitalization Ratio

6.34%

Chase Financial Statement

| TOTAL ASSETS | $1,947,794,000 |

| Cash and Due from Depository Accounts | $342,118,000 |

| Interest-Bearing Balances | $315,316,000 |

| Securities | $333,873,000 |

| Federal Funds Sold and Reverse Repurchase Agreements | $223,449,000 |

| Net Loans and Leases | $608,133,000 |

| Total Loans | $623,757,000 |

| Loan Loss Allowance | ($15,624,000) |

| Trading Account Assets | $271,231,000 |

| Bank Premises and Fixed Assets | $10,725,000 |

| Other Real Estate Owned | $2,384,000 |

| Goodwill and Other Intangibles | $37,339,000 |

| All Other Assets | $122,461,000 |

| TOTAL LIABILITIES | $1,796,301,000 |

| Total Deposits | $1,249,452,000 |

| Interest-Bearing Deposits | $861,943,000 |

| Deposits Held in Domestic Offices | $916,543,000 |

| % Insured | 29.01% |

| Federal Funds Purchased and Repurchase Agreements | $180,518,000 |

| Trading Liabilities | $110,693,000 |

| Other Borrowed Funds | $133,978,000 |

| Subordinated Debt | $28,774,000 |

| All Other Liabilities | $92,886,000 |

| TOTAL EQUITY | $151,493,000 |

| Total Bank Equity Capital | $151,237,000 |

| Perpetual Preferred Stock | $0 |

| Common Stock | $1,785,000 |

| Surplus | $77,582,000 |

| Undivided Profits | $71,870,000 |

| Noncontrolling Interests in Consolidated Subsidiaries | $256,000 |

| INCOME AND EXPENSE | |

| Net Interest Income | $16,472,000 |

| Total Interest Income | $19,313,000 |

| Total Interest Expense | ($2,841,000) |

| Provision For Loan and Lease Losses | ($-127,000) |

| Total Noninterest Income | $21,165,000 |

| Fiduciary Activities | $1,864,000 |

| Service Charges on Deposit Accounts | $2,209,000 |

| Trading Account Gains and Fees | $7,539,000 |

| Additional Noninterest Income | $9,553,000 |

| Total Noninterest Expense | ($24,482,000) |

| Salaries and Employee Benefits | ($13,215,000) |

| Premises and Equipment Expense | ($3,238,000) |

| Additional Noninterest Expense | ($8,029,000) |

| Pre-Tax Net Operating Income | $13,282,000 |

| Securities Gains (Losses) | $631,000 |

| Applicable Income Taxes | $3,713,000 |

| Income Before Extraordinary Items | $10,200,000 |

| Extraordinary Gains - Net | $0 |

| Net Income Attributable to Bank | $10,189,000 |

| Net Income Attributable to Noncontrolling Interests | $11,000 |

| Net Income Attributable to Bank and Noncontrolling Interests | $10,200,000 |

| Net Charge-Offs | $1,434,000 |

| Cash Dividends | $1,000,000 |

| Sale, Conversion, Retirement of Capital Stock, Net | $0 |

| Net Operating Income | $9,739,370 |

| PERFORMANCE AND CONDITION RATIOS | |

| Performance Ratios (%, Annualized) | |

| Yield on Earning Assets | 2.32% |

| Cost of Funding Earning Assets | 0.34% |

| Net Interest Margin | 1.98% |

| Noninterest Income to Average Assets | 2.19% |

| Noninterest Expense to Average Assets | 2.54% |

| Net Operating Income to Assets | 1.01% |

| Return on Assets (ROA) | 1.06% |

| Pretax Return on Assets | 1.44% |

| Return on Equity | 13.68% |

| Retained Earnings to Average Equity (YTD only) | 12.34% |

| Net Charge-offs to Loans | 0.46% |

| Credit Loss Provision to Net Charge-offs | -8.86% |

| Earnings Coverage of Net Loans Charge-Offs | 9.17(x) |

| Efficiency Ratio | 64.63% |

| Assets per employee ($ millions) | $9.7347 |

| Cash Dividends to Net Income (YTD only) | 9.81% |

| Condition Ratios (%) | |

| Loss Allowance to Loans | 2.52% |

| Loss Allowance to Noncurrent Loans | 55.29% |

| Noncurrent Assets Plus Other Real Estate Owned to Assets | 1.6% |

| Noncurrent Loans to Loans | 4.56% |

| Net Loans and Lease to Deposits | 48.36% |

| Net Loans and Leases to Core Deposits | 68.84% |

| Equity Capital to Assets | 7.76% |

| Core Capital Ratio | 6.34% |

| Tier 1 Risk-based Capital Ratio | 10.01% |

| Total Risk-based Capital Ratio | 12.87% |

| OTHER KEY FIGURES | |

| Asset-Side | |

| Average Assets | $1,930,905,667 |

| Average Earning Assets | $1,661,619,000 |

| Average Loans | $623,428,000 |

| Noncurrent Loans and Leases | $28,257,000 |

| Noncurrent Loans that are Wholly or Partially Guaranteed by the U.S. Government | $10,835,000 |

| Income Earned, Not Collected on Loans | $4,521,000 |

| Earning Assets | $1,678,551,000 |

| Long-Term Assets (5+ Years) | $287,180,000 |

| Average Assets, YTD | $1,930,905,667 |

| Average Assets, 2 Year | $1,947,972,000 |

| Total Risk Weighted Assets | $1,207,865,000 |

| Adjusted Average Assets for Leverage Capital Purposes | $1,905,940,000 |

| Life Insurance Assets | $10,257,000 |

| General Account Life Insurance Assets | $5,254,000 |

| Separate Account Life Insurance Assets | $5,003,000 |

| Hybrid Account Life Insurance Assets | $0 |

| Insider Loans | $1,484,000 |

| Loans and Leases Held For Sale | $3,779,000 |

| Liability-Side | |

| Volatile Liabilities | $670,338,000 |

| FHLB Advances | $42,687,000 |

| Unused Loan Commitments | $386,709,000 |

| Total Unused Commitments | $386,709,000 |

| Equity-Side | |

| Average Equity | $148,958,333 |

| Tier 1 (core) Risk-Based Capital | $120,912,000 |

| Tier 2 Risk-Based Capital | $34,590,000 |

| Derivatives | $2,147,483,647 |

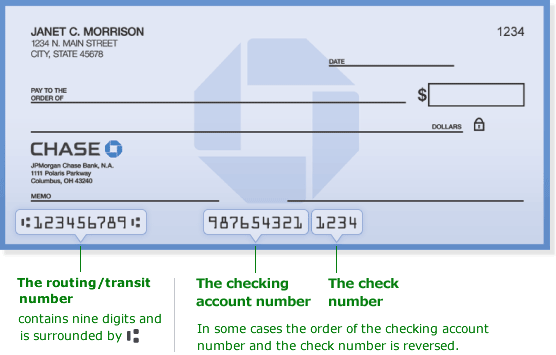

Routing numbers

Chevy Chase Bank Sterling routing numbers are listed on this site along with more information about how to find your routing number. Call Chevy Chase Bank for more information about routing numbers.

Routing numbers to Chevy Chase Bank in Sterling are collected manually from the banks official website or provided by the Federal Reserve Financial Services Database.

Routing/transit number can be obtained from a voided check.

All routing and transit numbers are also available below, by state.

| Region | Routing/Transit Number |

|---|---|

| Arizona | 122100024 |

| California | 322271627 |

| Colorado | 102001017 |

| Connecticut | 021100361 |

| Florida | 267084131 |

| Georgia | 061092387 |

| Idaho | 123271978 |

| Illinois | 071000013 |

| Indiana | 074000010 |

| Kentucky | 083000137 |

| Louisiana | 065400137 |

| Michigan | 072000326 |

| Nevada | 322271627 |

| New Jersey | 021202337 |

| New York – Downstate | 021000021 |

| New York – Upstate | 022300173 |

| Ohio | 044000037 |

| Oklahoma | 103000648 |

| Oregon | 325070760 |

| Texas | 111000614 |

| Utah | 124001545 |

| Washington | 325070760 |

| West Virginia | 051900366 |

| Wisconsin | 075000019 |

Job Openings

Open positions for Chevy Chase Bank in Sterling.

Consumer Complaint Stats

| Product / Complaint category | Complaints in 2013 |

|---|---|

| Mortgage | 63 |

| Bank account or service | 33 |

| Credit card | 8 |

| Debt collection | 4 |

| Money transfers | 4 |

| Consumer loan | 3 |

| Student loan | 1 |

Chevy Chase Bank Consumer Complaints (Virginia, 2013)

These numbers are gathered from the CFPB (Consumer Financial Protection Bureau) to give you a transparent overview of complaints Chevy Chase Bank in Virginia received in 2013.

Having problems with your bank? File a bank account or service complaint here.

Chevy Chase Bank Bank Hours (Business hours)

These are the bank hours for Chevy Chase Bank. Call (703) 444-8441 to learn more about office hours. Please note that these bank hours are general and other hours of operation may apply on certain holidays.

Mon 9:00 am - 6:00 pm

Tue 9:00 am - 6:00 pm

Wed 9:00 am - 6:00 pm

Thu 9:00 am - 6:00 pm

Fri 9:00 am - 6:00 pm

Sat 9:00 am - 4:00 pm

Sun Closed

Fees, interest rates and costs

There's currently no additional information available about fees or rates for Chevy Chase Bank.

Ask a question or leave a comment

We'd love to hear about your experience. Did you suffer through long waiting times, unprofessional staff or high fees or were you treated with great customer service, the business hours you were expecting and a great overall experience? This is your chance to share your thoughts about this branch and help other consumers get the best banking experience in your city.0 Comments, Questions or Reviews - Add

Be the first person to leave a comment, ask a question or review this bank.

Share your experience

We'd love to hear about your experience with Chevy Chase Bank. Did you suffer through long waiting times, unprofessional staff or high fees or were you treated with great customer service, the business hours you were expecting and a great overall experience? This is your chance to share your thoughts about this branch and help other consumers get the best banking experience in Sterling.Address

Bank location

Bank address

Chevy Chase Bank 45545 Dulles Eastern PlazaSterling, VA 20166

Navigation data

Area Code: 703Latitude: 39.024043

Longitude: -77.42437

County: Loudoun

FIPS county code: 51107 Ask question Write review

External resources

ATM locator

Routing Numbers

Official website

Business hours

Chevy Chase Bank Bank Hours (Business hours)

These are the bank hours for Chevy Chase Bank. Call (703) 444-8441 to learn more about office hours. Please note that these bank hours are general and other hours of operation may apply on certain holidays.

Mon 9:00 am - 6:00 pm

Tue 9:00 am - 6:00 pm

Wed 9:00 am - 6:00 pm

Thu 9:00 am - 6:00 pm

Fri 9:00 am - 6:00 pm

Sat 9:00 am - 4:00 pm

Sun Closed

Phone

Phone: (703) 444-8441

Fax: No listed fax number.

Email address

No listed email address.

Areas of practice

Chevy Chase Bank is listed under Banks in Sterling, Virginia .

Pro tip Browse Banks & bank offices in Sterling, Virginia by bank issue and category.

chase bank sterling dulles